Years ago, everyone, my name is Derek Ifasi. I'm the owner of a phosphate Financial Group. Today's topic I want to discuss with you is self-employed retirement plans and fully explain what are some of the pros and cons of self-employed retirement plan routes, and help you determine which would pertain best to your goals. Now, there are two major options that an individual has regarding self-employed retirement plans. You have to think of it kind of like a bucket, an accumulation bucket. The first plan is set up for pre-tax monies. This means that if you're going to place dollars into a specific retirement bucket every single year, those dollars are going to be tax-deductible. So it's known as pre-tax, meaning tax-deductible. This bucket grows and grows over time, and by the time you're ready to retire, you have something known as a fifty-nine and a half world, meaning you can't touch that bucket until age fifty-nine and a half. When you pull out any sorts of monies from that account, it's going to be fully taxable on the back end. In a simple example, let's say if someone self-employed made a hundred thousand dollars and they decide to place ten percent of their monies into a type of pre-tax retirement plan. They take ten thousand dollars and place it into that plan. At the end of the year, it's going to show their adjusted gross income to be ninety thousand dollars because ten thousand is tax-deductible. The contributions they're placing into that bucket will grow based upon a specific percentage rate of return, whether that's in a fixed account, an index account, a mutual fund account, or whatever that is. Individuals who set it up this way in these pre-tax qualified retirement accounts are able to get that tax...

Award-winning PDF software

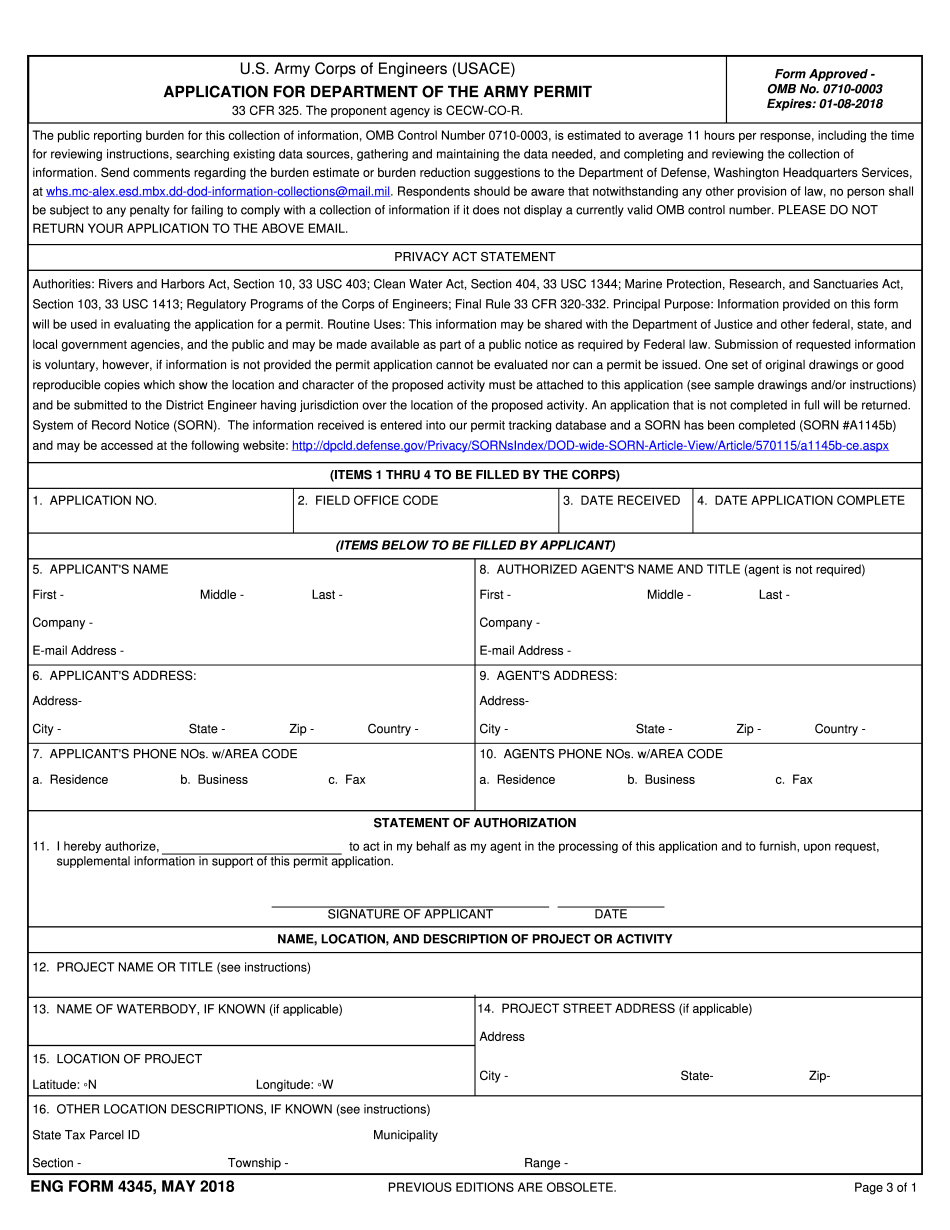

Section 408 permit Form: What You Should Know

The following are suggestions for how your staff can conduct the annual performance related self-evaluations, including: · Read this checklist and the previous examples. · Choose the following questions from the list to create a self-evaluation How would you rate your performance? In which of the following areas would you classify [your] performance as: Excellent Good Fair Terrible No Satisfactory: (5) No one or few outstanding factors are listed on this form. Why? · For each item/area, select one of three possible performance grades. (2) As many performance grades as you wish. (6) Not applicable. In which of the following areas would you classify your performance as: Excellent Good Fair Terrible No Satisfactory: (5) No one or few outstanding factors are listed on this form. Why? · For each item/area, select one of three possible performance grades. (2) As many performance grades as you wish. (6) Not applicable. Please complete this section and return it by the date specified. We will not be able to conduct a performance review if you do not provide all the information available. What will be our final decision? Please do not submit your form more than 6 weeks prior to the date you expect to receive your payment, please. If you don't send it by this date, you will not be eligible to receive your payment, and we may cancel the entire transaction. When you are ready to submit your form, please click on the button below. We will not allow you to submit your form more than 6 weeks prior to the date you expect to receive your payment, please. If you don't send it by this date, you will not be eligible to receive your payment, and we may cancel the entire transaction. When you are ready to submit your form, please click on the button below. Click here to complete your Form 1 of the Performance Based Performance Evaluation. When you submit this form, your information will be securely encrypted. Thank you for your participation! Once your form is complete, we will not be able to conduct a performance review if you do not provide all the information available. We will mail the entire document to you for review within approximately 3 business days. To expedite your request, please include a reference number or other proof you have submitted a letter of intent.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do ENG 4345, steer clear of blunders along with furnish it in a timely manner:

How to complete any ENG 4345 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your ENG 4345 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your ENG 4345 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Section 408 permit